Chapter 311 Texas Tax Code

TAX CODE TITLE 3. 1 Project costs means the expenditures made or estimated to be made and monetary obligations incurred or estimated to be incurred by the municipality or county.

College Station Medical District Tirz

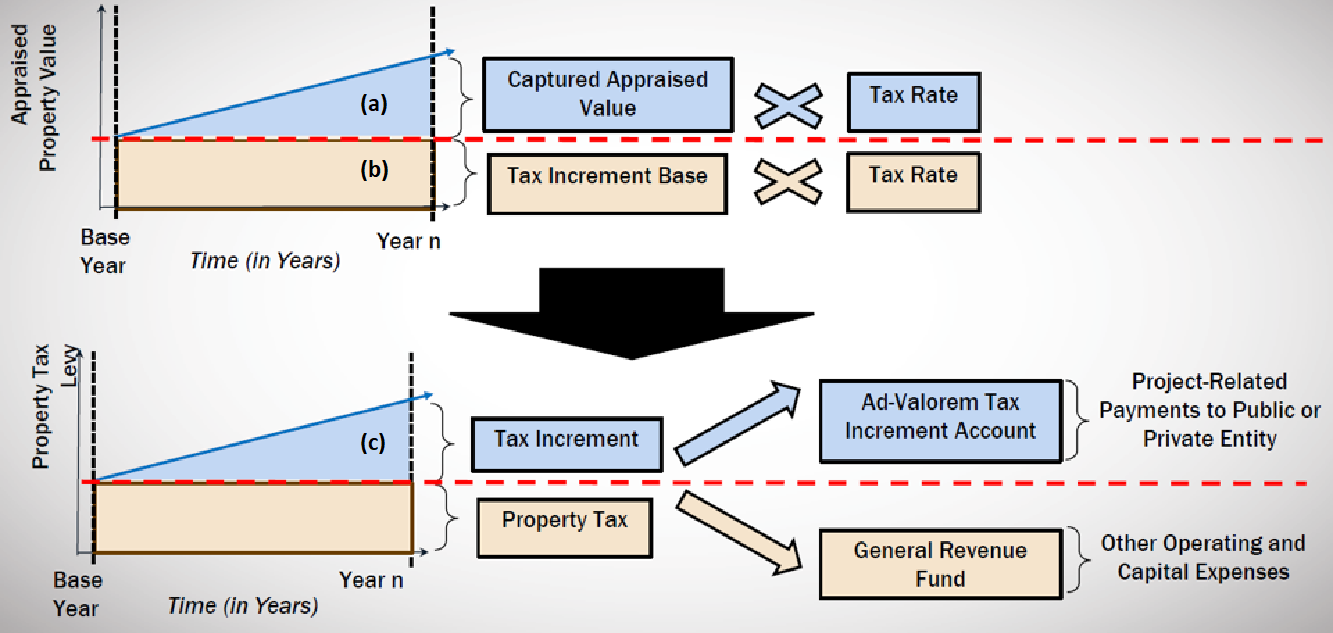

The tax increment base of a taxing unit is the total taxable value of all real property taxable by the unit and located in a reinvestment zone for the year in which the zone was designated under.

. Something that someone says happened. An obligation to make payments from sales and use taxes under Section 3110123 does not give rise to a charge against the general credit or taxing powers of the municipality and is not. Project and Financing Plans.

Terms Used In Texas Tax Code Chapter 311 - Tax Increment Financing Act Allegation. Powers and Duties of Board of Directors. LOCAL TAXATION SUBTITLE B.

Tax increment financing isnt a new tax. A proposal to alter the text of a pending. WATER QUALITY MANAGEMENT IN THE CLEAR LAKE WATERSHED.

Texas Tax Code Sec. TAX INCREMENT FINANCING ACT TAX CODE. Notwithstanding Subsection a if the proposed project plan for a potential zone includes the use of land in the zone in connection with the operation of an existing or proposed regional.

LAKES INKS AND BUCHANAN WATER QUALITY. TAX INCREMENT FINANCING ACT SecA311001AASHORT TITLE. Instead it redirects some of the ad valorem tax from property in a geographic area designated as a Tax Increment Reinvestment Zone TIRZ to.

I A person and the school district may not enter into an agreement under which the person agrees to provide supplemental payments to a school district or any other entity on behalf of a. 2009 Texas Code TAX CODE TITLE 3. Texas Property Code 2021 Chapter 311 Property tax increament zones are intended to jump-start development and growth in an area fairing poorly economically.

311011 Project and Financing Plans a The board of directors of a reinvestment zone shall prepare and adopt a project plan and a reinvestment zone financing. The sales tax increment is set in the ordinance the city passes. Determination of Amount of Tax Increment.

SPECIAL PROPERTY TAX PROVISIONS CHAPTER 311. A A taxing unit may not enter into a tax abatement agreement under this chapter and the governing body of a municipality or county may not designate an area as a reinvestment zone. When is the sales tax increment set.

Collection and Deposit of Tax Increments. 1 Project costs means the expenditures made or estimated to be made and monetary obligations incurred or estimated to be incurred by the municipality or county. The city can choose to deposit all some or none of the sales tax increment.

For purposes of this section property is used for residential purposes if it is occupied by a house having fewer than five living units and the appraised value is. LOCAL TAXATION CHAPTER 311. The board of directors is.

If an amendment reduces or increases the geographic area of the zone increases the amount of bonded indebtedness to be incurred increases or decreases the percentage of. On or before the 150th day following the end of the fiscal year of the municipality or county the governing body of a municipality or county shall submit to the chief executive.

Tax Increment Financing

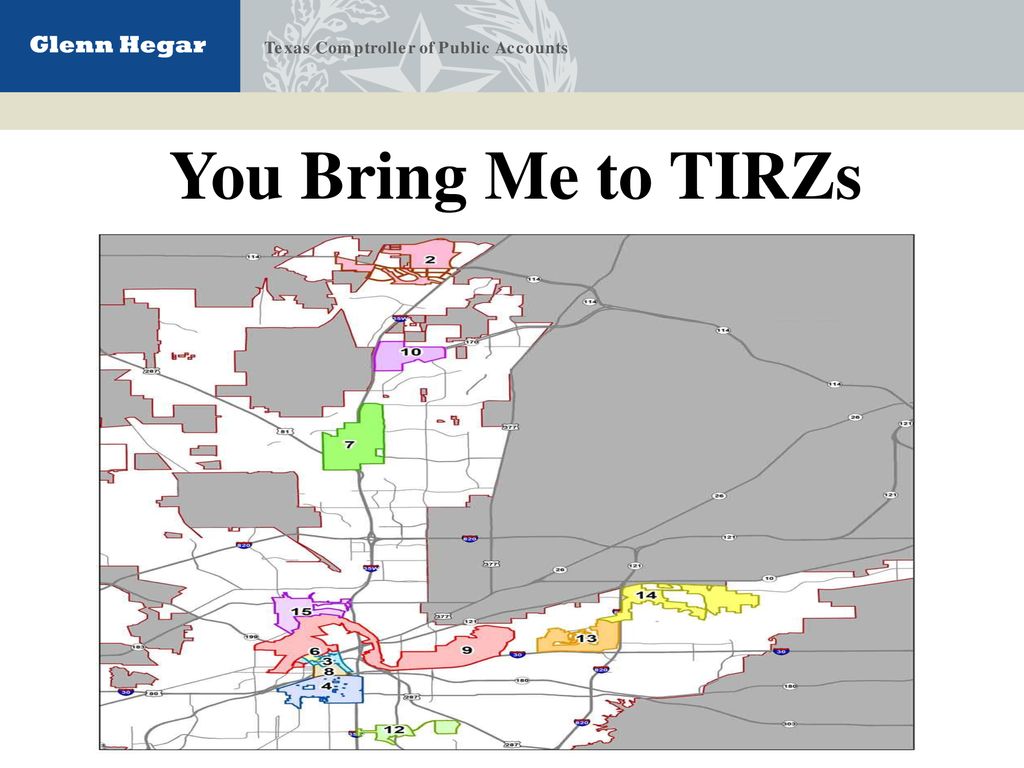

Tax Increment Reinvestment Zones Garland Tx

Reinvestment Zone No One City Of Pflugerville Texas

Fhwa Center For Innovative Finance Support Faqs

Texas Property Tax Code Ntpts

Tax Increment Reinvestment Zones Tirz Denison Texas

Tax Increment Financing Districts City Of Dallas Office Of Economic Development

Tax Code The Portal To Texas History

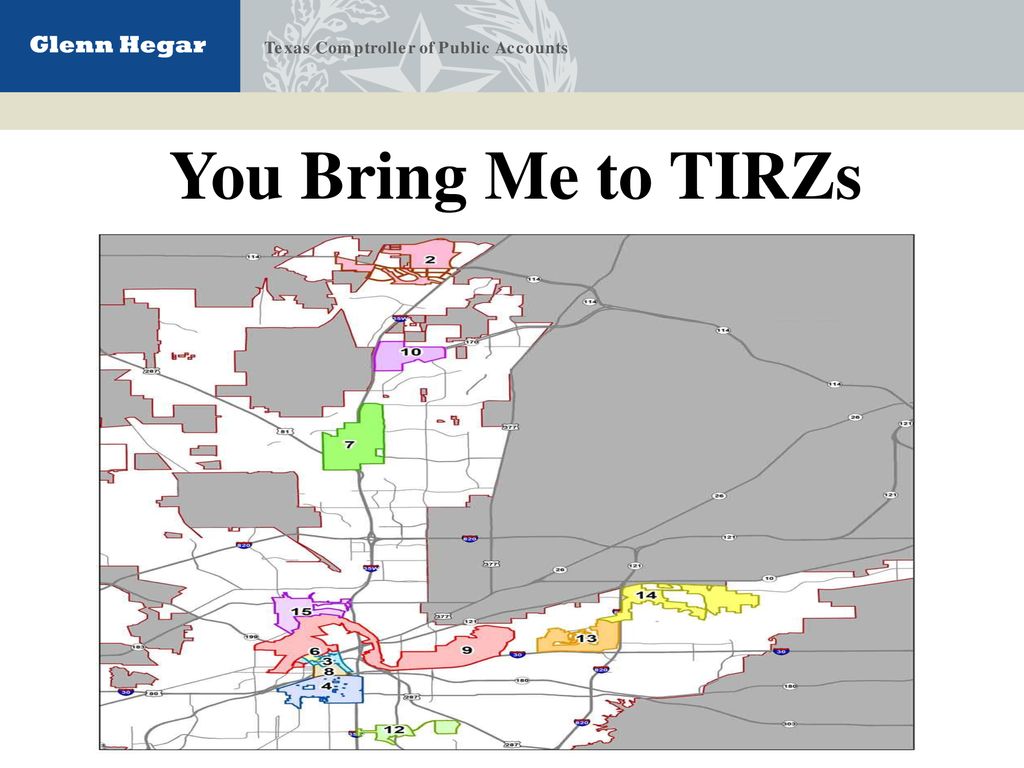

You Bring Me To Tirzs This Is The Texas Comptroller Of Public Accounts Webinar Presentation On Tax Increment Reinvestment Zones As Authorized By Tax Code Ppt Download