Capital gains calculator 2020

Hi Nissar If you wish to claim exemption from Long Term Capital Gains LTCG tax you have to invest your capital gains within six months from the date of sale of your property or before the due date of filing income tax return usually 31st July in notified capital bonds issued by the National Highways Authority of India NHAI or Rural. If your gains are less than the Capital Gains Tax allowance then you dont need to report them.

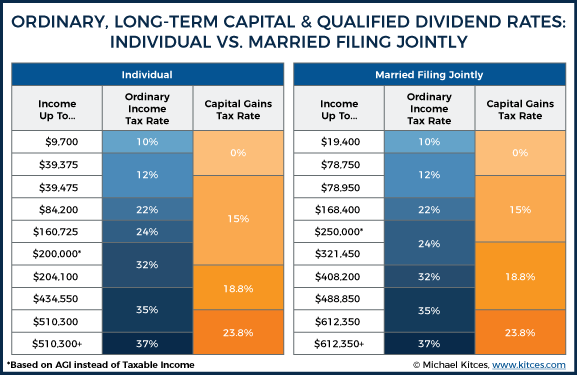

The Tax Impact Of The Long Term Capital Gains Bump Zone

Short-term capital gains are gains apply to assets or property you held for one year or less.

. This calculator assumes no exclusions to wages and salary income such as contributions to 401k retirement plans. 10 and decided to redeem the same in July 2019 say at a NAV of Rs. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

You can reduce your total tax bill by claiming capital losses against capital gains. Illustration of Long Term Capital Gain Tax Calculation. If you sell a property that is not your primary residence for more than you paid for it you will have a capital gain which is taxable.

CGTcalculator is an online capital gains calculator for UK share trades. Capital gains tax is normally not payable on gains you make on the sale of your only or main home. Yes No Not sure Get SARS Tax Dates and Deadlines in your Inbox.

In FY 2020-21 should use form ITR-2 to file their income tax returns. For example in 2020 if you have a capital gain of 5000 and a capital loss of 2000 your tax will only be applied to 3000 of capital gain. Capital gains and dividends Capital gains from the sale of assets held for longer than one year and qualifying dividends.

But if you own mo. DO I HAVE TO PAY. 2021 capital gains tax rates For taxes due in April 2022 or in October 2022 with an extension.

The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. And length of ownership of the asset. Capital assets that you hold for more than one year and then sell are classified as long-term on Schedule D and Form 8949 if needed.

They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. It calculates both Long Term and Short Term capital gains and associated taxes. There are two main categories for capital gains.

For property sales made between 6 April 2020 and 26 October 2021 the window to pay your CGT bill was 30 days. You pay 127 at 10 tax rate for the next 1270 of your capital gains. Long-term capital gains are taxed at only three rates.

Apr 28 2020 0445pm EDT. The first 1270 of your gain is. SARS Capital Gains Tax Calculator Work out the Capital Gains Tax Payable on the disposal of your Asset.

Long-term capital gains taxes are more favorable than short-term capital gains taxes because they are almost certain to be taxed at a lower rate. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. Effective from April 1 2020 an individual salaried taxpayer has been given the option to continue with the old tax regime and avail deductionstax exemptions such section 80C 80D deductions HRA LTA tax exemptions etc.

Long-term capital gains tax rate. You need to feed your property sale purchase date along with values. September 13 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index.

100000 at a NAV of Rs. Well tell you when you need to file along with tax tips and updates. From this date Capital Gains are calculated at either an 18 or 28 tax rate dependent upon the amount of your other taxable income during the tax year.

Or to opt for the new tax regime and forgoing approximately 70 deductions and tax exemptions. Are selling your primary residence Have owned your home for at least two years Have lived in your home for two of the past five years. Use our jargon-free calculator to complete and securely submit your tax return direct to HMRC.

Here are ways to avoid or minimize capital gains tax on a home sale. Apart from federal income tax the capital gains calculator also. To reduce the Capital Gains Tax you pay on the sale of property for that year you need to report your losses to HMRC in your Self-Assessment tax-return.

You pay no CGT on the first 12300 that you make. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. Our capital gains tax calculator can help you estimate your gains.

Our capital gains tax calculator can provide your tax rate for capital. Your gain is essentially the sales price of the property minus the present value of purchase price as well as any other allowable expenses. Suppose Amit had invested in debt-oriented mutual funds in April 2016 and the investment amount was Rs.

For Capital Gains made during the 20102011 Tax Year the calculation is quite complicated as the Government changed the tax scheme from 23rd June 2010. Individuals having income from capital gains more than one house property foreign assets or income from foreign assets etc. The capital gains tax exemption only applies if you.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. Short-term capital gains are taxed at your ordinary income tax rate. The calculator based on your input calculates both short-term capital gains as well as long-term capital gains tax.

The government lets you deduct money that youve invested into your home from your homes sale price when you report capital. There is option to include cost of repairsimprovement that you might. You can carry them forward to the next tax year.

Long-term gains and losses. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. In the above case the gains arising from the sale will be considered as long term capital gain and the benefit of.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Long-term capital gains apply to assets that you held for over one year and are taxed. What Qualifies in.

You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains. 0 15 and 20. Capital gains tax CGT breakdown.

The capital gains tax is economically senseless. The precise rate depends on the tax bracket youre in. Calculator How Property Tax Works.

It implements the Inland Revenues onerous share matching rules including the 30 day rule. Have you disposed of an asset this year. Capital Gains Calculator Ireland.

The advantage to a net long-term gain is that generally these gains are taxed at a lower rate than short-term gains. Weve got all the 2021 and 2022 capital gains tax rates in one. Here is the step by step guide to file ITR-2 on new income tax portal.

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

2020 Capital Gains Tax Calculator See What You Ll Owe Smartasset Capital Gain Capital Gains Tax Tax

Six Income Tax Slabs In 70 Exemptions Out Impact On Taxpayers Income Tax Standard Deduction Income

How To Save Long Term Capital Gain Tax U S54ec How To Apply For Rec And Nhai Bonds In Offline Mode Youtube Capital Gains Tax Capital Gain How To Apply

Www Fiphysician Com Wp Content Uploads 2019 09 Ltc

Free Income Tax Efiling In India Cleartax Upload Your Form 16 To E File Income Tax Returns Filing Taxes Tax Refund Income Tax Return

Large Cap Funds To Invest In 2k20 Futures Contract Investment Portfolio Investing

1 000 In 2008 2020 Inflation Calculator Computer Science Degree Economic Indicator Effects Of Inflation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Download Free Four E Books By Icai On Gst Simple Tax India Ebook Tax Free Bonds Pay Calculator

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message T Selling House Tax Deductions Selling Your

Spending Trends By Generation Personal Finance Personal Finance Finance Money Management

All About Filing Of 10ee Form By Pensioners With Rule 21aaa In 2022 Tax Forms Pensions Retirement Benefits

How To Calculate Rate Of Return On Maturity From A Money Back Life Insurance Policy Life Insurance Policy Credit Card App Insurance Money

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations Business Tax Deductions Small Business Tax Deductions Tax Deductions

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help